Expand into 32 cities with the strategic goal of building a strong regional presence that could generate substantial revenue, positioning these markets as key contributors alongside London.

Secure a first-mover advantage to establish market dominance, shape early customer and driver perceptions, and set a pricing and service standard that competitors must follow.

Develop competitive strategies such as exclusive partnerships, localized promotions, and driver loyalty programs to protect market share as Uber entered, leveraging the strength of established regional operations.

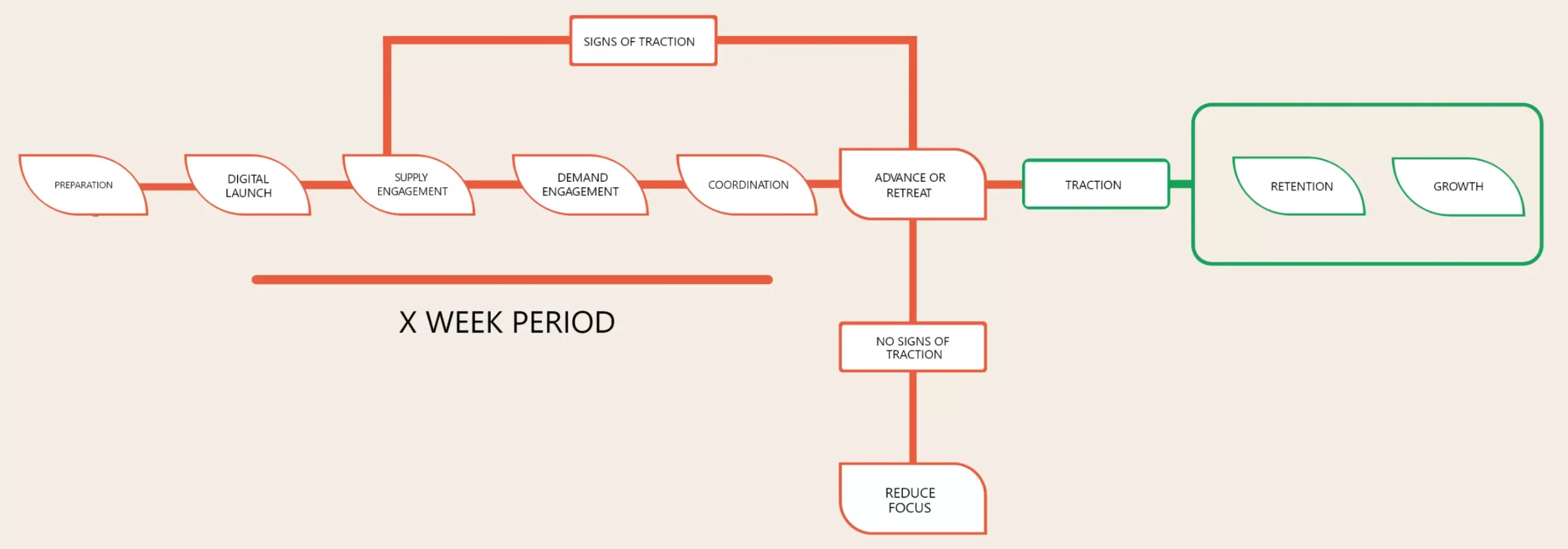

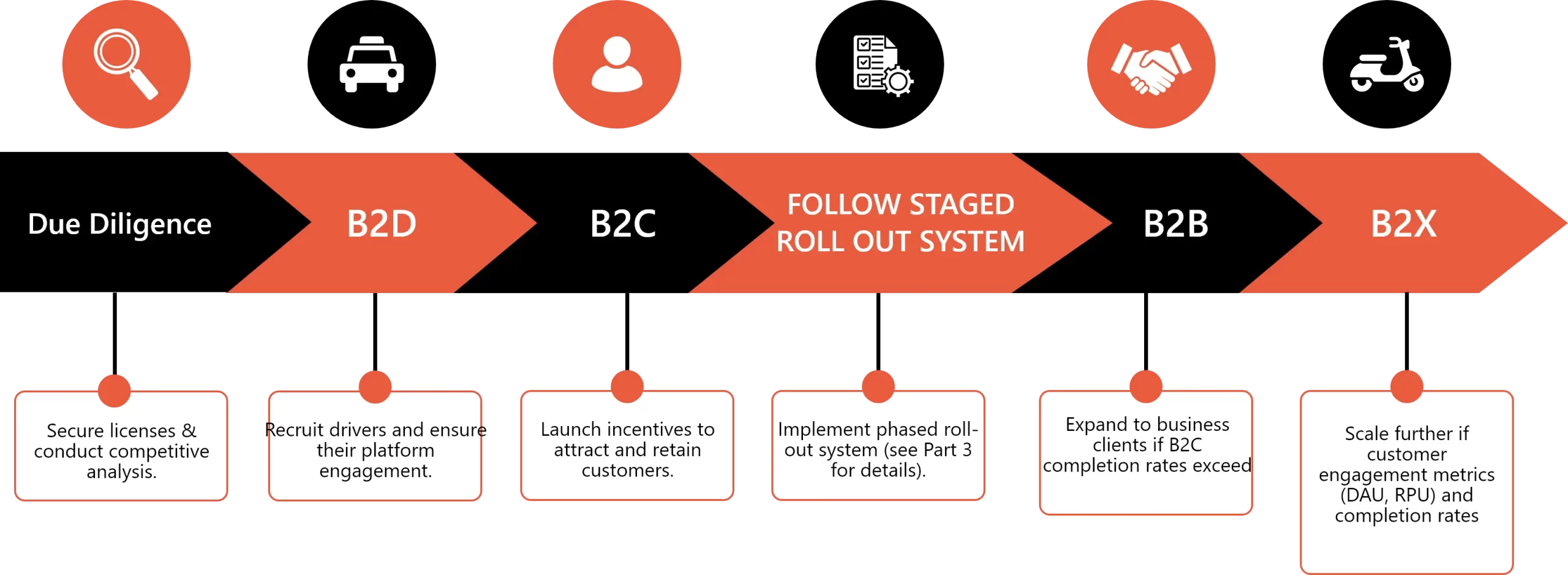

Engage drivers through targeted incentives, onboarding support, and ongoing engagement initiatives to keep them active and loyal to the platform.

Execute marketing and awareness campaigns to highlight the convenience, savings, and advantages of using the service over competitors.

Develop direct sales strategies, customized pricing models, and value-added services to attract business clients, showcasing the efficiency and reliability of the service.

Recognize and respond to unique challenges and opportunities in each city, customizing approaches based on local competition, regulations, and customer behavior.

32 Cities Launched

Successfully launched in 32 cities, achieving first-to-market status ahead of Uber, solidifying early market leadership and creating a strong competitive moat.

£1 Million In Revenue In Year 1

Demonstrated rapid market traction and revenue generation, establishing a solid financial foundation early on.

£10 Million In Revenue By Year 3

Achieved significant growth with key cities showing strong retention, even as competition intensified, defending market share against Uber’s entry.

10,000+ Drivers Acquired

Built a substantial driver network, enhancing platform liquidity and creating a critical defense against Uber by securing supply-side loyalty.

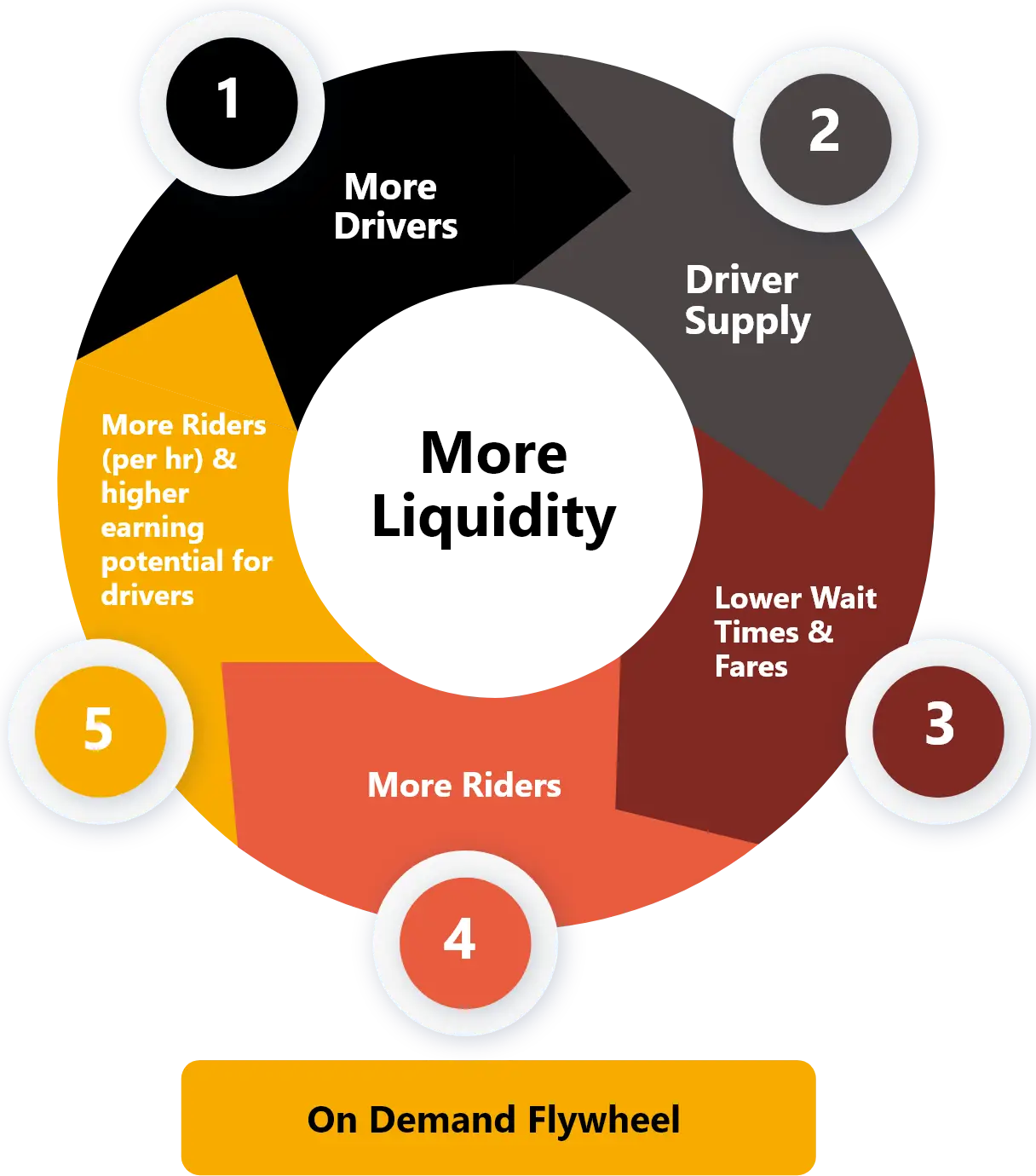

On-demand transport platforms rely on liquidity network effects, where the balance of supply (drivers) and demand (riders) drives the overall efficiency and growth of the service. The cycle begins by increasing the availability of drivers, which reduces wait times and fares for riders, making the service more attractive.